In May and June of 2025, Texas Governor Greg Abbott signed pivotal legislation that introduces a permanent research and development (R&D) tax credit and makes significant amendments to the state's franchise tax rules. These changes which take effect in 2026, aim to enhance the state's appeal for businesses engaged in innovative research while simplifying the tax landscape.

Read full story

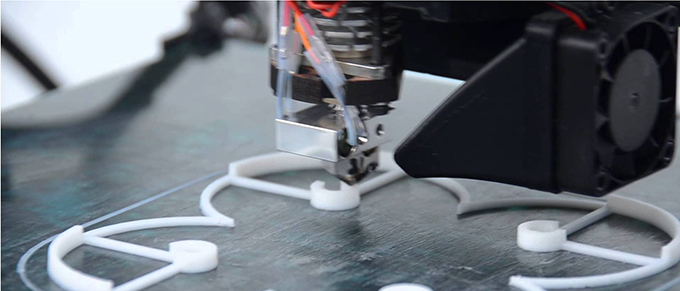

Enacted in 1981, the Federal Research and Development (R&D) Tax Credit allows a credit of up to 13 percent of eligible spending for new and improved products and processes. Companies engaged in 3D printing should be taking full advantage of all available federal and state tax credits. Problem is not many companies utilizing 3D printing even know they are qualified for these tax credits.

Read full story

Biotechnology companies are continuously undertaking qualified research activities to solve the greatest challenges facing our society. Whether it’s finding a cure for cancer, protecting against bio-terror threats, or creating renewable energy sources, biotech and life science companies can take advantage of the R&D tax credits for their qualified research expenditures associated with these activities.

Read full story

Since the start of Trump’s second term, a wave of corporations have announced major expansions of their U.S. manufacturing operations. While tariffs and trade policy are often cited in recent headlines, a far more powerful motivation is at play: the new R&D tax credits introduced under the One Big Beautiful Bill Act (OBBBA).

Signed into law on July 4, OBBBA has essentially reshaped the financial incentives for companies that build, innovate, and manufacture here in America. The legislation locks in permanent, expanded R&D tax credits that allow businesses to offset significant portions of their investment in new facilities, advanced technologies, and domestic innovation pipelines.

Read full story

The federal tax code has included R&D tax credits to businesses for more than three decades. Contrary to a common misperception, however, R&D tax credits are not limited to scientists and laboratory-based researchers. In fact, many of the activities conducted by architecture firms qualify, and the benefit can mean tens of thousands of dollars in tax savings.

Read full story

Plant based food businesses must be able to change and adapt to the new dietary trends and consumers’ ever-changing personal eating habits. These efforts to create better plant based products or more nutritious products typically involve extensive experimentation and testing of new formulations, recipes, process parameters, and packaging methods. Research and development tax credits are available to support companies that are actively creating or improving these ways.

Read full story

Companies engaged in the design, installation, and fabrication of HVAC systems and components may be eligible to receive a significant tax credit.

Read full story

1. 100% Bonus Depreciation is Fully Restored

Bonus depreciation has been an extremely valuable tax strategy for real estate inves tors and business owners. After gradually phasing down over the last few years, it’s now back in full force.

Read full story

If your company conducts activities within the winemaking industry there is a strong likelihood that your company can take advantage of the R&D tax incentive.

Read full story

The“ One Big Beautiful Bill Act” better known as the Big Beautiful Bill or OBBBA was signed into law on July 4th. While much attention has centered on its game-changing overhaul of R&D amortization rules, there’s more good news for businesses and real estate owners: the bill delivers significant updates for cost segregation, energy incentives, and sustainability focused tax planning.

Read full story