R&D is essential to driving technological change in aquaculture, and many people working in the industry engage in R&D activities on a weekly basis. These activities could qualify for a significant tax credit that shouldn’t be passed up.

Read full story

Did you know that Electrical Contractors may be eligible to receive Research and Development (R&D) tax credits?

Read full story

With a longstanding reputation for leadership in aerospace, agriculture, healthcare and manufacturing, Ohio remains one of the nation’s most innovative states. To further encourage innovation, the state provides incentives for certain research and development (R&D) activities that bring new ideas to market, promote economic growth, create jobs and help keep Ohio competitive.

Read full story

Companies performing research and development (R&D) activities in the state of Indiana may be eligible to receive state R&D tax credits as well as Federal tax credits with certain qualifications.

Read full story

CPAs and taxpayers familiar with the Federal R&D tax credit program may not be fully aware of the scope of state R&D credits available across the United States.

Read full story

CPAs and taxpayers familiar with the Federal R&D tax credit program may not be fully aware of the scope of state R&D credits available across the United States.

Read full story

It is always prudent and necessary to look for all possible tax deductions to offset the amounts of tax we pay. It is also extremely beneficial to find tax credits to apply. As a California S corporations that does research and development activities, you have some options available to you that can save thousands of dollars.

Read full story

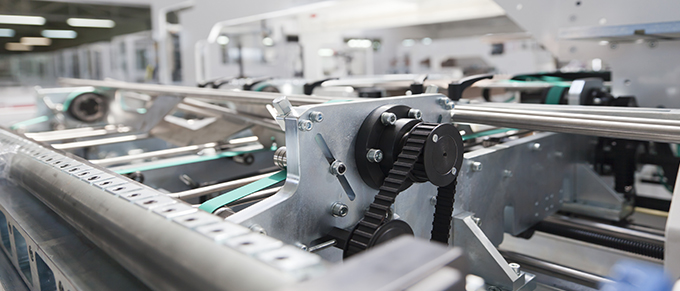

Does your manufacturing business improve a process or product for the automotive industry? Do you work to make an automotive product cleaner or more efficient? Or, perhaps you provide technical solutions that make production work more efficiently. If you are conducting any of these activities, are you taking advantage of the research and development (R&D) tax credit?

Read full story

Choosing an R&D tax partner that can work seamlessly with your firm can offer great value to both your firm and your clients. Here are seven important qualities to keep in mind when choosing the right R&D expert.

Read full story

When you think about it, packaging is essential for any product being sold. From storage to transport to the end user, package designers seek ways to advance the quality, functionality and safety of their products—all within compliance of regulatory guidelines. Many package designers would be surprised to discover that many of the activities they already are conducting qualify for valuable tax credits.

Read full story