Start-ups and small to medium size companies can be using all or part of their R&D credits against their payroll tax liability.

Read full story

With careful planning and the understanding of applicable state tax codes, cannabis entrepreneurs can take proactive steps to reduce their state tax liabilities.

Read full story

For companies that are carrying out innovative work in LED technology in the United States, R&D tax credits are a valuable resource.

Read full story

R&D tax credits should not be overlooked by any industry that is performing daily research for their nanotech business, as they could be losing valuable profits.

Read full story

Businesses in the robotics industry are performing research and development in everyday activities and most are not aware these operations could qualify for a dollar-for-dollar reduction of their income tax liability.

Read full story

Research and development is a critically important aspect of the cannabis industry’s current and future growth.

Read full story

U.S. pharmaceutical companies spend billions of dollars annually conducting research to develop new or improved medicines. Now is the optimal time to take full advantage of the R&D tax credits that are available to them.

Read full story

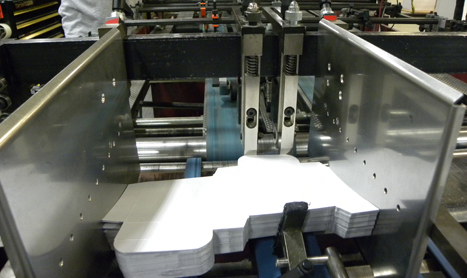

When you think about it, packaging is essential for any product being sold. From storage to transport to the end user, package designers seek ways to advance the quality, functionality and safety of their products—all within compliance of regulatory guidelines. Many package designers would be surprised to discover that many of the activities they already are conducting qualify for valuable tax credits.

Read full story

On January 1, 2016 North Carolina repealed their state R&D tax credit. It's important to note that unused North Carolina R&D tax credits may be carried forward for up to 15 years.

Read full story

Tax Point Advisors difference of consistent and experienced project management and advances the responsiveness that Tax Point Advisors provides for CPAs and their clients.

Read full story