Are you afraid to claim the R&D tax credits?

If you are, you are not alone. Many companies in the U.S. are afraid to claim the R&D tax credits that are truly theirs because they don't want the hassle and expense of an audit. According to the IRS, only about 10% of eligible companies claim the R&D tax credits. That's a sad statistic considering how lucrative these tax credits are, and how businesses need cash during these hard economic times. This low number of taxpayers claiming their R&D tax credits falls in two categories -- they don't know about them, or they are afraid they will get denied in an IRS audit. The R&D tax credits are one of the most lucrative credits available to businesses.

Read full story

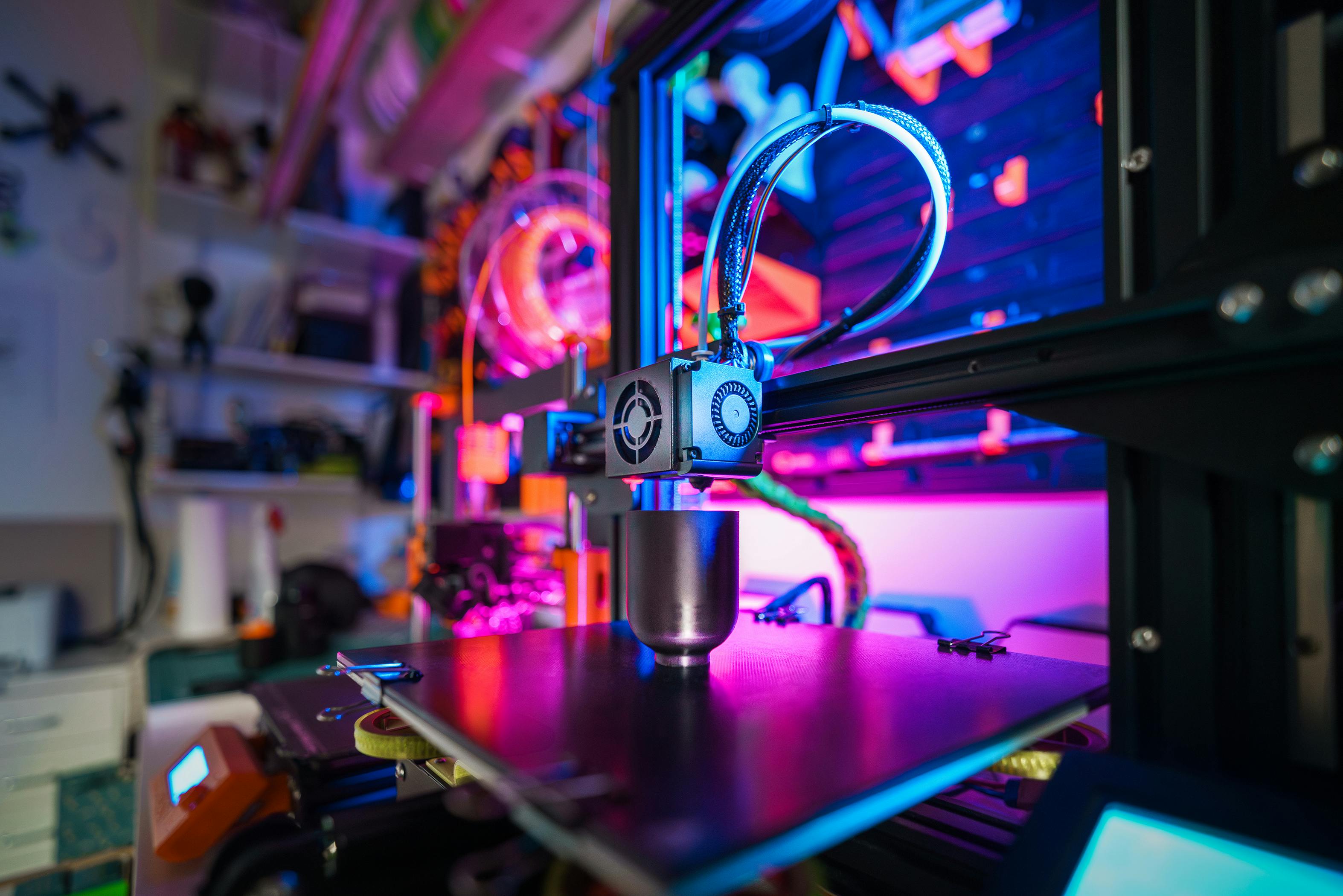

In recent years, the manufacturing industry has witnessed a revolution with the emergence and wide adoption of 3D printers. These innovative machines have transformed the way companies design, prototype, and manufacture products. Not only has 3D printing streamlined production processes, but it has also opened up a myriad of opportunities for companies to take advantage of research and development (R&D) tax credits.

Read full story

The downturn in the US economy in recent years has led U.S. game developers to seek ways of cutting costs, including sub-contracting or outsourcing game development. In order to keep these and other jobs on American soil, Congress created an R&D credit to give American companies, including game developers, a very lucrative incentive to continue their development here.

Read full story

The wireless communications industry has been research-driven for the past 20 years. The future of each company depended and continues to depend on their R&D staffs. The Information and Communication Technologies (ICT) have driven innovation around the world even affecting our social behaviors. Few, if any, industries have been and are so competitive. Product cycles are short and fast and driven by innovation. Having enough money to drive the research is crucial for them. This makes tax breaks like R&D credits even more important.

Read full story

Cost segregation is an extremely beneficial and widely used tax strategy, used by commercial property owners to significantly reduce taxable income as well as increase cash flow.

Read full story

Many companies that manufacture plastic injection molds do not realize that their business is filled with research and development (R&D) activities that qualify for valuable tax credits.

Read full story

When it comes to the United States tax code, many businesses throw their collected hands up in the air and say, "I give." This is even truer when it comes to R&D tax credits. For many businesses, they simply believe the system is too complicated for us to claim R&D tax credits. While the ins and outs of tax law can take some time to understand, they are not so complicated that they should not be taken advantage of.

Read full story

Tax Point Advisors applauds current efforts by Washington legislators to enact the Tax Relief for American Families and Workers Act of 2024.

Read full story

In 2022, the Inflation Reduction Act (IRA) was signed into law. It's a 10-year plan designed to improve a range of tax laws, upgrade technology and simplify the filing of tax returns. Most media coverage surrounding the signed Inflation Reduction Act (IRA) focused on its health care and climate change sections. However, the measure also improves a frequently disregarded federal tax credit for qualified small businesses. The Inflation Reduction Act of 2022 ("IRA") has increased and modified the qualified small business payroll tax credit for increasing R&D activities.

Read full story

In today's competitive business landscape, it is crucial for companies to stay ahead of the curve and maximize their potential. One way to do so is by taking advantage of Oregon's 2024 R&D Tax Credits. In 2023 Oregon introduced a new refundable Research and Development (R&D) tax credit (HB2009), for its state taxpayers, to encourage them for qualifying work performed on semiconductors. Although the timeline to apply for these tax credits has passed for the current tax year (December 1, 2023), now is the time to start gathering your information and applying for the credit for the upcoming 2024 tax year.

Read full story