R&D Tax Credit Opportunities for Companies in the Manufacturing Industry that Utilize 3D Printers

Posted by Jeffrey Feingold on 03.13.24

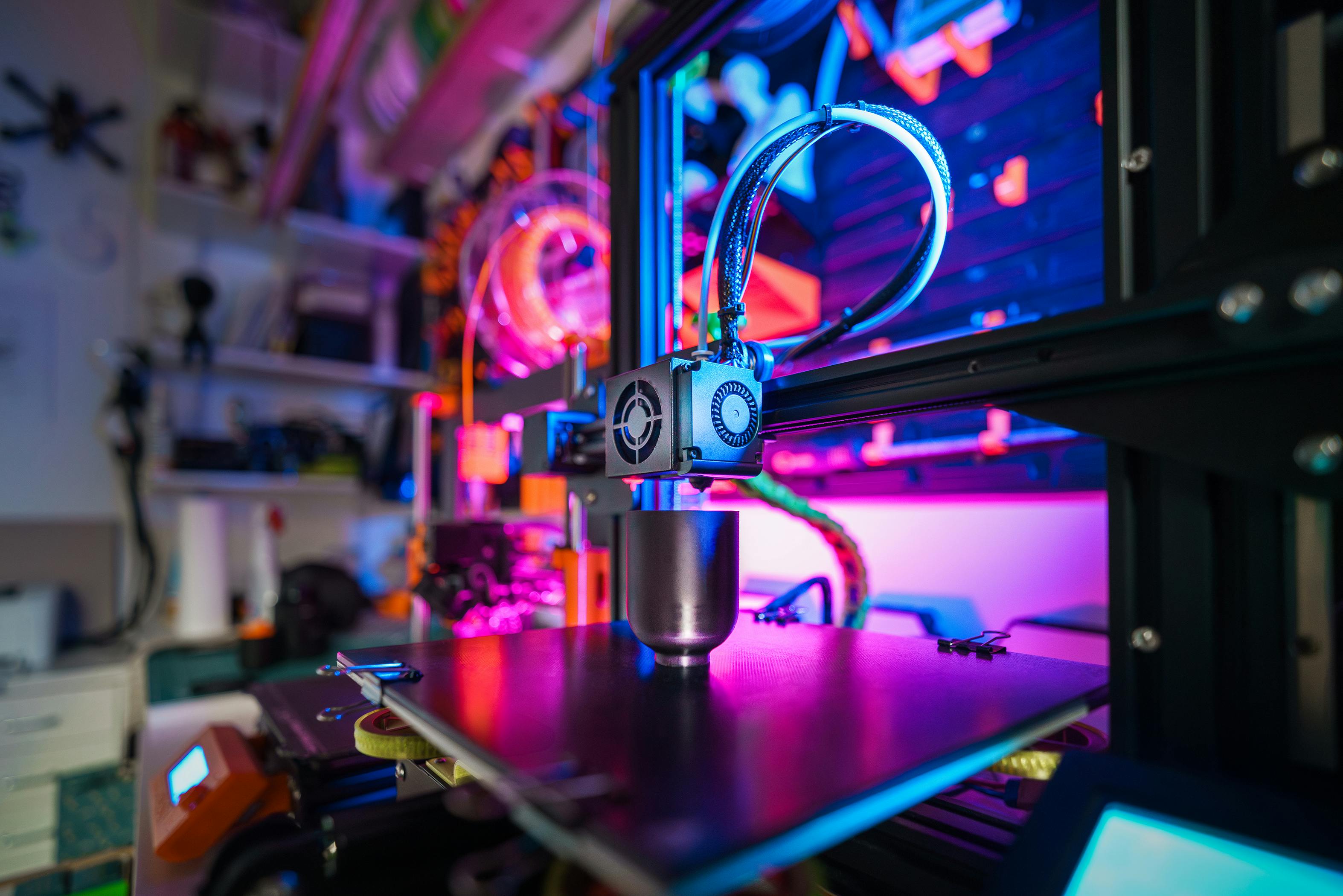

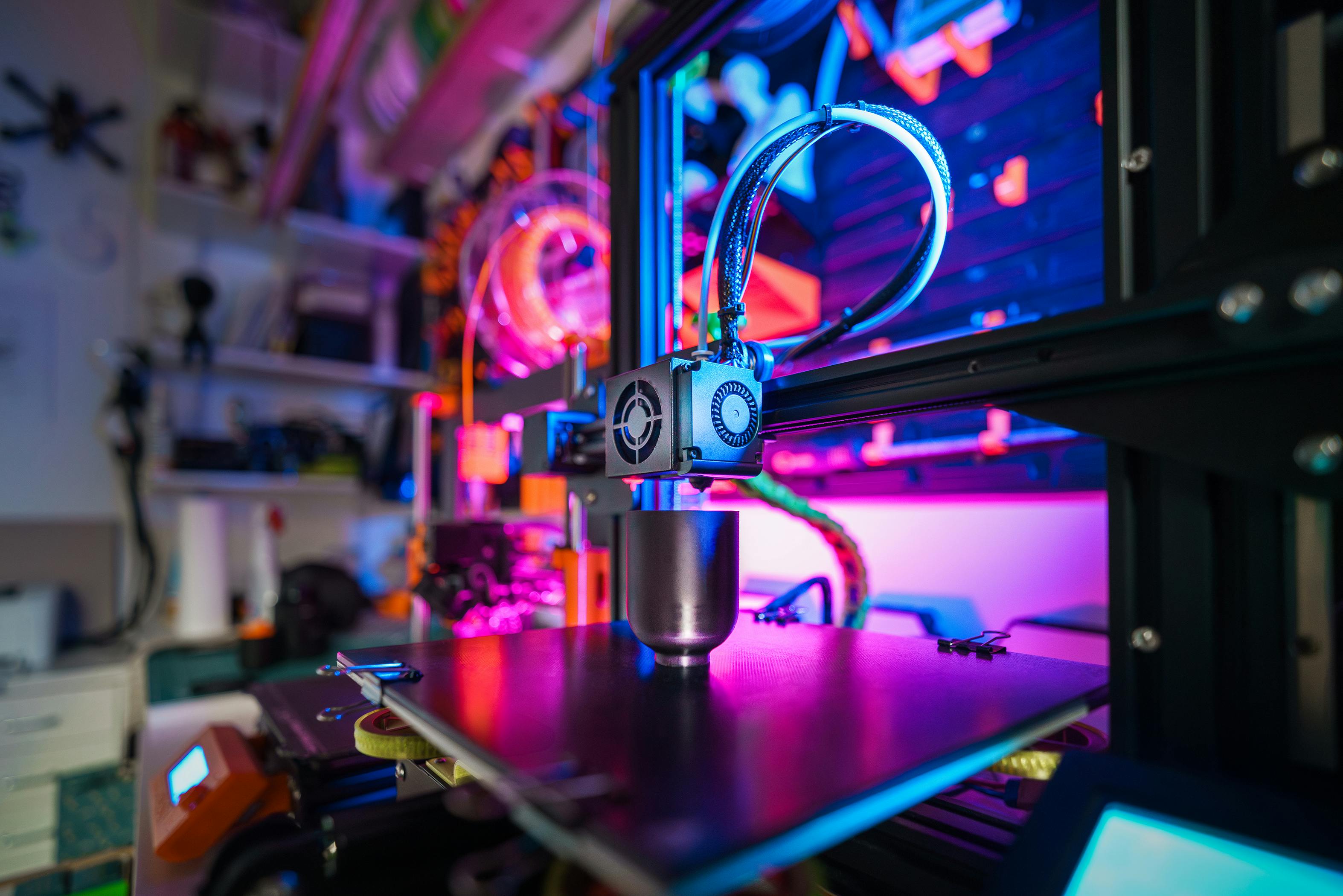

In recent years, the manufacturing industry has witnessed a revolution with the emergence and wide adoption of 3D printers. These innovative machines have transformed the way companies design, prototype, and manufacture products. Not only has 3D printing streamlined production processes, but it has also opened up a myriad of opportunities for companies to take advantage of research and development (R&D) tax credits.

3D printing, also known as additive manufacturing, allows companies to create three-dimensional objects by adding layers of material based on digital designs. This technology has gained popularity in the manufacturing industry due to its ability to produce complex and customized parts, reduce material waste, and accelerate product development cycles. With 3D printers becoming more accessible and affordable, an increasing number of companies are incorporating this technology into their manufacturing processes.

R&D Tax Credits

R&D tax credits are government incentives designed to promote innovation and stimulate economic growth. These credits provide a financial advantage to companies engaged in research and development activities, including those in the manufacturing sector. By utilizing 3D printers, manufacturing companies are inherently engaged in R&D, as they constantly experiment with new materials, processes, and designs to improve their products and production methods

Qualifying for R&D Tax Credits

To qualify for R&D tax credits, companies in the manufacturing industry must demonstrate that their activities meet certain criteria. Firstly, the activities must aim to develop new or improved products, processes, or software. This requirement aligns perfectly with the innovative nature of 3D printing, as companies continuously strive to enhance their designs and production techniques. Additionally, companies must face technical uncertainties and actively conduct research activities to overcome these challenges, which is often the case in 3D printing.

3D printers have revolutionized the manufacturing industry by enabling companies to enhance their product development processes and create more innovative products. By incorporating 3D printing into manufacturing operations, companies can tap into the potential of R&D tax credits. These incentives provide financial support to manufacturing firms engaged in research, development, and experimentation activities. The use of 3D printers inherently involves R&D, making manufacturing companies utilizing this technology prime candidates for tax credits. As more companies embrace 3D printing, it is crucial for them to explore and leverage R&D tax credit opportunities that can not only drive innovation but also provide a competitive advantage in the manufacturing industry.

Manufacturing companies utilizing 3D printers can leverage R&D tax credits in various ways. They can claim tax credits on expenses related to materials, software development, prototyping, and testing. These costs can be significant, especially for companies experimenting with new materials, optimizing parameters, or creating novel designs. Furthermore, companies can also claim tax credits for the wages of employees involved in R&D activities, including engineers, designers, and technicians working on 3D printing projects. If your company is conducting 3D printing research and development activities, you may qualify for and benefit from R&D tax credits. Potentially eligible costs for R&D tax credits include wages, cost of supplies, cost of testing, and contract research expenses. The activities and associated expenditures of any company can qualify for the R&D tax credit if the activities meet the following four-part test established by the IRS:

- Qualified Purpose - The purpose of the research must be to create a new or improved product, process, or formulation, resulting in increased performance, function, reliability or quality.

- Technological in Nature – The research must rely on the hard sciences, such as engineering, physics, chemistry, biology or computer science.

- Elimination of Uncertainty – Activities must overcome some unknowns, such as uncertainty as to capability, optimal design, or optimal methodology.

- Process of Experimentation – Experimentation can be demonstrated through prototypes, simulations, systematic trial and error, or other methods of evaluating alternatives to achieve a desired result.

Your CPA or qualified R&D tax credit expert like Tax Point Advisors, can easily help you determine whether your 3D printing activities meet the criteria of the 4 part test by conducting a tax credit study.

Find Out if Your Activities Qualify

Unfortunately, many manufacturing businesses assume that R&D is synonymous with laboratories and therefore miss out on the opportunity to make R&D tax claims; failing to realize that activities conducted to support the needs of their clients could be categorized as research and development.

Your company is in a position to take advantage of the credit if you do any of the following:

• Developing, improving, or testing new concepts and technology

• Creating new, improved or more reliable products, formulas or processes

• Automating, streamlining or improving internal processes

• Designing new or improved equipment

• Improving the efficiency in manufacturing operations

• Alternative new material and compound testing

• Designing, developing and improving automotive parts

• Designing, constructing and testing product prototypes

• Conducting tests to maintain quality assurance

• Testing to meet compliance regulations and safety requirements

• Efforts to improve environmental safety or worker safety

• Developing environmental consideration for overall operations

• Creating prototypes or models, including computer generated models

• Developing improved or new jigs, fixtures, dies, tools or gauges

Download our free e-book: The Manufacturer's Guide to R&D Tax Credits

If you think your company might be performing activities that may qualify for the R&D tax credit, don’t let the potential tax savings go unclaimed. Tax Point Advisors has the experience and knowledge to assist you and your company to identify the daily activities that are already taking place to help get you the best possible credit.

Tax Point Advisors works with small or large businesses that may qualify for R&D tax benefits. For more information, call us at 800-260-4138 or please leave us a message below.