Unlocking Innovation: The Benefits of R&D Tax Credits for Manufacturing Companies Using Software Development

Posted by Jeffrey Feingold on 05.22.25

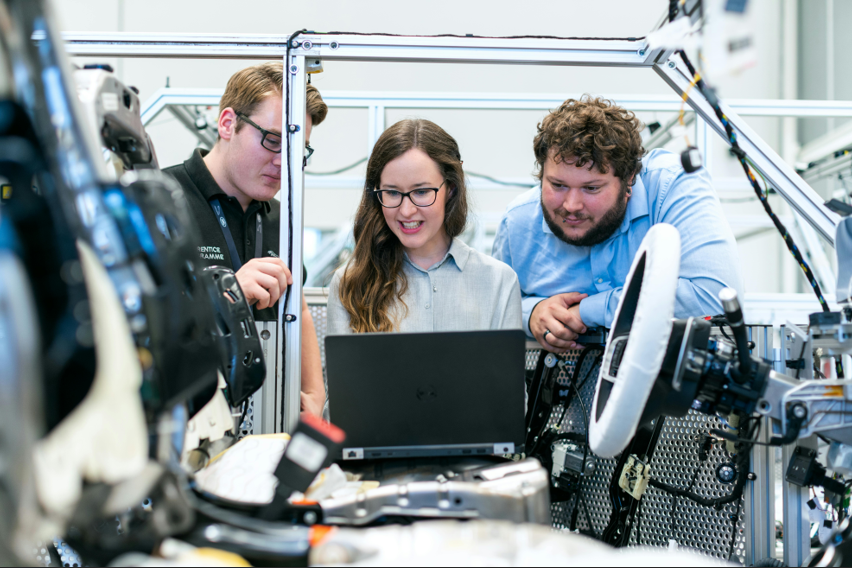

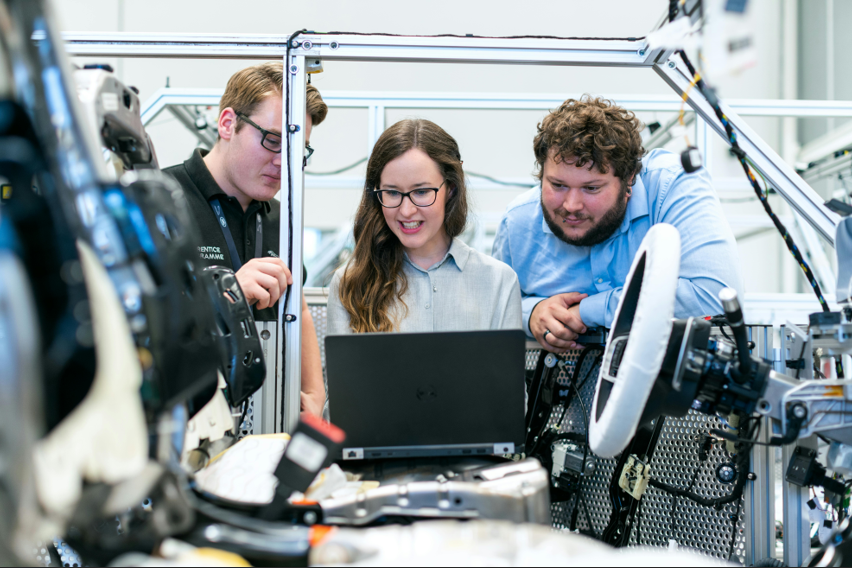

In today's manufacturing landscape, innovation isn't just a competitive advantage - it’s a necessity. From process automation to intelligent systems that streamline production and workforce management, manufacturing companies are increasingly turning to software development to drive growth and efficiency. Many of these companies may be unaware that they could be eligible for significant financial incentives through Research & Development (R&D) Tax Credits.

R&D Tax Credits are federal and, in many cases, state incentives designed to encourage U.S. companies to invest in innovation. While traditionally associated with labs and white coats, these credits are much broader than many assume. Any company developing or improving products, processes, or software may qualify, including manufacturers integrating software into their operations.

Software development is revolutionizing the manufacturing industry. Whether it’s developing custom ERP solutions, integrating IoT devices on the production floor, or creating automation tools for workforce efficiency, these innovations often qualify as R&D under IRS guidelines.

Examples of Qualifying Activities

• Developing or customizing manufacturing software

• Building automation systems for production or inventory tracking

• Creating proprietary algorithms or control systems for machinery

• Enhancing production processes with data analytics or AI

• Implementing cloud-based platforms to manage remote teams

• Improving quality control using custom software solutions

Key Benefits of the R&D Tax Credit

Significant Tax Savings

Companies can receive a dollar-for-dollar reduction in their federal tax liability, often resulting in tens or hundreds of thousands of dollars in savings. Many states offer additional R&D incentives, amplifying the benefits.

Cash Flow Improvements

Startups and small businesses can benefit too. The Payroll Tax Credit allows qualified small businesses (less than $5 million in gross receipts and within the first five years of revenue) to apply up to $500,000 of the R&D credit against payroll taxes annually.

Increased ROI on Innovation

By reducing the cost of innovation, the R&D tax credit encourages companies to reinvest in new technologies, accelerating time to market and boosting competitiveness.

Employee Retention and Growth

Software-driven innovation often requires skilled employees. The tax credit can help offset salary costs for developers, engineers, and technical staff, making it easier to grow or retain a high-performing team.

Eligibility Retroactively

Many businesses can amend prior year tax returns - typically up to three years back to claim unutilized R&D credits, offering a powerful opportunity for a cash influx.

Common Misconceptions

Despite the broad applicability of the credit, many manufacturers overlook it due to common myths:

• “We’re not a software company.” You don’t need to sell software—if you develop it to improve your processes, you may still qualify.

• “Our project failed.” Success isn’t required. In fact, technical uncertainty is one of the qualifying criteria.

• “We’re just customizing existing systems.” Customization and integration often involve technical challenges that qualify.

Next Steps for Manufacturers

To determine eligibility, manufacturers should:

1. Identify software and process improvements made over the past 3–4 years.

2. Document technical challenges and the development or testing efforts involved.

3. Consult a tax professional or R&D credit specialist with experience in manufacturing and software development.

As software continues to transform the manufacturing industry, R&D tax credits provide a powerful and often underutilized tool to fuel innovation and reduce costs. Manufacturers investing in custom software, process automation, or digital transformation should seriously consider the financial advantages of this incentive. In a sector where margins are tight and innovation is critical, leveraging the R&D Tax Credit isn’t just smart, it’s strategic.

Find Out if Your Activities Qualify

The R&D tax credit can be a lucrative incentive for innovative businesses. Now is the time to consider whether activities performed by your company qualify for major cash-saving tax credit opportunities.

Tax Point Advisors, a firm with expertise in working with small and midsize companies, works with businesses that may qualify for R&D tax benefits. For more information, read our e-book: The Manufacturer’s Guide to R&D Tax Credits. For more information, call us at (800) 260-4138, or please leave us a message below.