By now you undoubtedly have heard the news about the One Big Beautiful Bill Act H.R. 1 (aka "OBBA") which was signed into law on Friday, July 4. The impact on the US based R&D taxpayers is both positive and immense!

Read full story

A major tax Bill restoring full R&D expensing has been approved by the Senate. Trump's "One Big Beautiful Bill Act" has been narrowly approved by the Senate in a 51 to 50 vote. The Bill now goes back to the House for reconciliation with the Senate version.

Read full story

As the owner of a job shop, do you know that you may qualify for valuable research and development (R&D) tax credits? That means you can receive large sums of money for activities you and your employees are already conducting in your shop. In fact, the R&D tax credit is one of the most lucrative federal tax credits available, and most states have implemented their own programs modeled on the federal program.

Read full story

For a long time, R&D tax credits were mostly associated with large companies conducting research in software, manufacturing, pharmaceutical and high-tech companies. As a matter of fact, many activities associated with agriculture can and do qualify. When you stop to think about it, R&D is essential to driving technological change in agriculture, and many people working in the industry engage in R&D activities on a weekly basis—activities that could qualify for a significant tax credit.

Read full story

For years, American innovation has faced a quiet, but formidable adversary: Section 174 of the Internal Revenue Code. Under its recent interpretation, small and mid-sized businesses have been forced to amortize research and development (R&D) costs over a five-year period, rather than deducting them in the year they are incurred. This accounting change, enacted in the Tax Cuts and Jobs Act of 2017 and implemented starting in 2022, has made claiming the R&D tax credit far less attractive and feasible for many companies, especially startups and growth-stage businesses. Now, help may finally be on the horizon.

Read full story

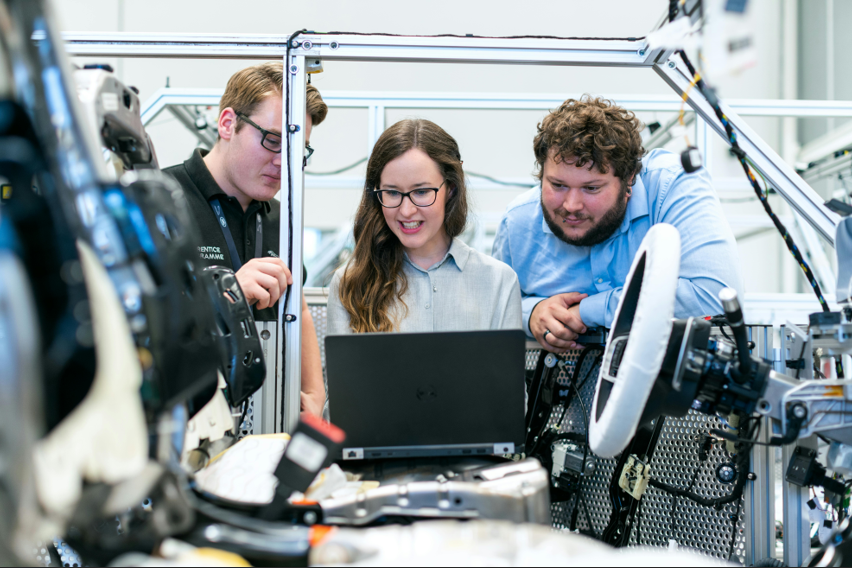

If your company operates in the medical equipment manufacturing industry, there is a strong chance that you would benefit from an R&D tax credit study.

Read full story

In today's manufacturing landscape, innovation isn't just a competitive advantage - it’s a necessity. From process automation to intelligent systems that streamline production and workforce management, manufacturing companies are increasingly turning to software development to drive growth and efficiency. Many of these companies may be unaware that they could be eligible for significant financial incentives through Research & Development (R&D) Tax Credits.

Read full story

Many companies that manufacture plastic injection molds do not realize that their business is filled with R&D activities that qualify for valuable tax credits—credits that could be used to reinvest in their business.

Read full story

Does your manufacturing business improve a process or product for the automotive industry? Do you work to make an automotive product cleaner or more efficient? Or, perhaps you provide technical solutions that make production work more efficiently. If you are conducting any of these activities, are you taking advantage of the research and development (R&D) tax credit?

Read full story

Texas has firmly established itself as a national leader in business innovation and technology. One of the most anticipated topics in tax discussions is whether the state will extend and modify the Texas Research and Development Credit (R&D Credit), which is currently set to expire on December 31st, 2026.

Read full story