For years, American innovation has faced a quiet, but formidable adversary: Section 174 of the Internal Revenue Code. Under its recent interpretation, small and mid-sized businesses have been forced to amortize research and development (R&D) costs over a five-year period, rather than deducting them in the year they are incurred. This accounting change, enacted in the Tax Cuts and Jobs Act of 2017 and implemented starting in 2022, has made claiming the R&D tax credit far less attractive and feasible for many companies, especially startups and growth-stage businesses. Now, help may finally be on the horizon.

Read full story

If your company operates in the medical equipment manufacturing industry, there is a strong chance that you would benefit from an R&D tax credit study.

Read full story

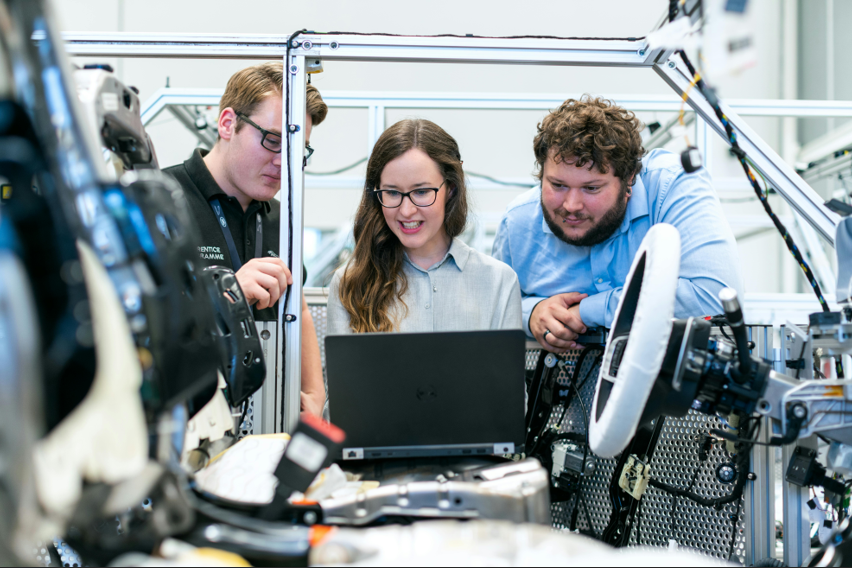

In today's manufacturing landscape, innovation isn't just a competitive advantage - it’s a necessity. From process automation to intelligent systems that streamline production and workforce management, manufacturing companies are increasingly turning to software development to drive growth and efficiency. Many of these companies may be unaware that they could be eligible for significant financial incentives through Research & Development (R&D) Tax Credits.

Read full story

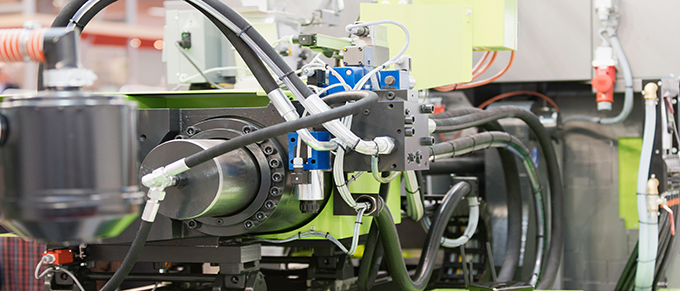

Many companies that manufacture plastic injection molds do not realize that their business is filled with R&D activities that qualify for valuable tax credits—credits that could be used to reinvest in their business.

Read full story

Does your manufacturing business improve a process or product for the automotive industry? Do you work to make an automotive product cleaner or more efficient? Or, perhaps you provide technical solutions that make production work more efficiently. If you are conducting any of these activities, are you taking advantage of the research and development (R&D) tax credit?

Read full story

Texas has firmly established itself as a national leader in business innovation and technology. One of the most anticipated topics in tax discussions is whether the state will extend and modify the Texas Research and Development Credit (R&D Credit), which is currently set to expire on December 31st, 2026.

Read full story

Does your aerospace business resolve technological challenges through the innovative use of processes and products? Despite its name, the research and development (R&D) tax credit program includes far more activities than research, patents and laboratory work.

Read full story

House Republicans' Fiscal Year 2025 Budget Resolution, passed on February 25, 2025, and is poised to make significant changes in the tax landscape with a $4.5 trillion tax-cut plan. A key component of this initiative is the proposed elimination of Section 174 amortization, a rule requiring businesses to spread their R&D deductions over five years (and 15 years for foreign costs) since 2022. This change may allow for immediate expensing and enhance Section 41 R&D tax credits.

Read full story

Healthcare businesses that develop software for the industry across the US are often missing out on federal research and development (R&D) tax credits. This credit is designed to reward companies for increasing their investments in research and development. However, many healthcare companies developing software may not realize they could qualify for this incentive.

Read full story

Video games have become a popular form of entertainment over the past several decades, and the gaming market is projected to continue its growth. As video games have become more technically complex, software developers have had to enhance graphics, improve performance, and create new features. The nature of game development makes game developers strong candidates for Research and Development (R&D) tax credits. These tax credits encourage innovation by allowing companies to claim up to 22% of their qualified research expenses (QREs) as tax

credits.

Read full story